Our lawyers in Dubai offer legal services in a wide area of law, covering corporate law, commercial law, criminal business law, intellectual property, business consulting etc., for foreign entrepreneurs who choose the Middle East for doing business. Dubai is one of the most attractive cities in this region and is going to become a global financial center, like London and New York. Many foreign investors who decide every year to set up companies in Dubai or extend their businesses on the UAE market need the legal services of a Dubai lawyer for company formation, obtaining the specials permits and licenses for their economic activity, mergers and acquisitions, liquidation of companies etc. All these legal services are provided by our law firm that offers tailored services for every business’ needs, no matter if you handle a small, medium or large business.

| Quick Facts | |

|---|---|

| Business registration services |

We offer business incorporation services in Dubai. |

|

Bank account opening services |

Our Dubai lawyers can assist with the opening of personal, corporate and merchant bank accounts. |

|

Support for free zone company registration |

Our law firm in Dubai can help investors open free zone companies. |

| Assistance for immigrating to UAE |

Our immigration lawyers in Dubai offer assistance for obtaining residence permits. |

| Guidance in employment matters |

Our employment lawyers are at the service of employers and employees, including foreign workers. |

| Support in Civil Law matters |

We offer tailored legal support related to the Civil Law and Sharia Law. |

| Company liquidation services |

Our Dubai law firm offers company liquidation support. |

| VAT registration support |

VAT registration is one of the newest services provided by our tax lawyers. |

| Assistance in obtaining a freelance visa |

We can advise on applying for a freelance/remote worker visa for Dubai. |

| Debt collection assistance | Our law firm in Dubai offers support in amicable and court debt recovery. |

| Support in renting/buying a property |

Our lawyers can help you rent/acquire real estate in Dubai. Assistance in purchasing properties through the residency by investment scheme is also available. |

| Assistance in applying for investment visas |

Our immigration lawyers in Dubai can assist in the process of applying for investor visas. |

| Litigation support (YES/NO) |

Yes |

| Trademark registration services |

Our lawyers will help you register a trademark in UAE. |

| Other services |

– wealth management, – notary services, – recognition of foreign judgments, – assistance in Family Law matters |

Sometimes it is difficult for foreign investors from all over the world to travel to UAE in order to register a company in Dubai, to recover a debt or liquidate a company. There are numerous legal firms in Dubai through which you can request various services. We have solutions for every issue – our attorneys in Dubai may represent you in front of the local authorities through a power of attorney.

The main legal services you can rely on our solicitors in Dubai for

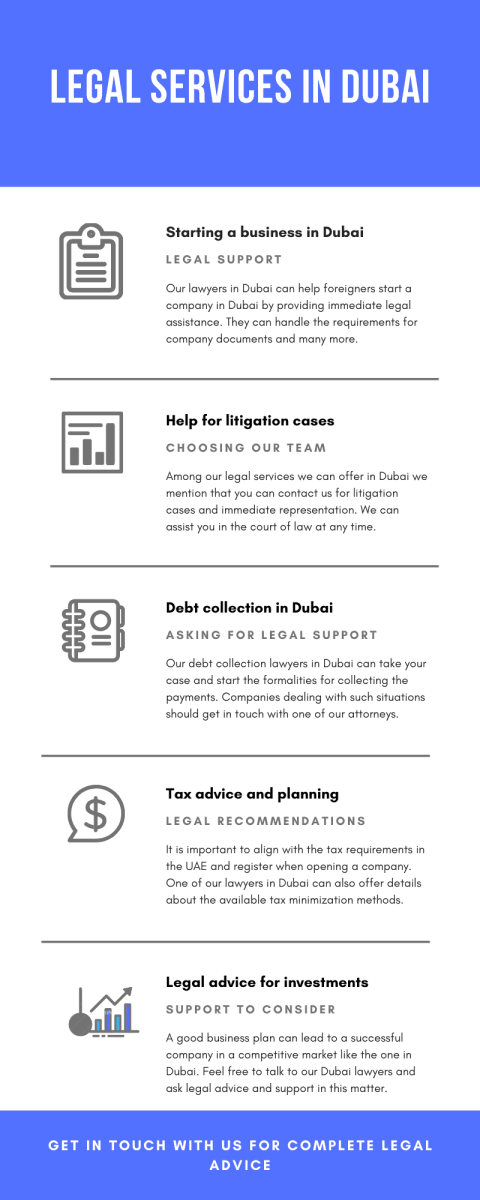

The UAE has different rules and laws compared to Western countries, especially when dealing with civil law matter. For this purpose, the assistance of a law firm in Dubai is crucial. However, there are numerous other areas of the law you can rely on us for. Among these, we mention the following:

- guidance and assistance in incorporating businesses in Dubai and its free zones and obtaining all the necessary licenses to operate;

- we can also provide business liquidation services, if you want to close a Dubai company;

- debt collection procedures can also be completed by our solicitors in Dubai in an amicable manner, however, court support is also offered;

- we can also be your legal guide in resolving disputes through mediation, arbitration or traditional litigation in court;

- we offer legal support in immigration to Dubai through business creation or employment. You can become your own boss by launching your own business with the freelance visa Dubai. This is a new type of visa created by the government in the attempt of attracting foreign talent to the UAE. If you want to apply for it, do not hesitate to get in touch with our immigration lawyers in Dubai who can explain all its requirements.

- we are also at your disposal if you want to acquire a property in Dubai under the regulations imposed here;

- we will also guide on the tax regulations that you need to respect in this country.

One of our main and most requested services cover the Civil Code of the UAE which refers to guidance in marriage registration, divorce and child custody, inheritance and other similar matters that are quite different compared to those of other countries, considering some of them rely on the Sharia Law.

Making a difference and knowing how to interpret to law, so that providing tailored and correct support is the core of our legal services in Dubai.

The fact that there are various legal firms in Dubai you can obtain assistance from is at your advantage, as some of them are international offices that can cover a cross-border regulations.

Litigation in Dubai

A company opened in Dubai may have legal issues with its business partners and it will need a lawyer in Dubai in order to represent it in litigations and other legal procedures. The foreign entrepreneurs don’t know the local legislation related to business issues, so they will need legal advice and consultation from time to time. Our lawyers in Dubai offer a wide range of legal services, from representation in front of the court to legal consultation, advice, and support.

When involved in a litigation case, after the petition is filed by the plaintiff, the Dubai court will begin the hearings. In order to be validated, a claim must contain several elements:

- the names and addresses of both the plaintiff and the defendant;

- complete details about the companies involved in the process;

- clear information about the claim (statements offered by both parts);

- details whether an amicable procedure took place or not.

Dubai courts usually hear the cases in public, except for certain cases. If appointing a lawyer, a power of attorney must first be drafted. This way, the lawyers will be able to represent their clients in their absence. Starting with 2015, the UAE Government amended the Civil Procedural Code in order to allow for streamlined proceedings related to notification and service of summons before the proceedings begin. One of the most important amendments refers to the possibility of filing claims and appeals (in certain cases only) electronically.

We may also offer you additional services, such as accounting, virtual office, translations etc. Our lawyer in Dubai will help you hire the employees for your company and they will keep you in touch with the latest regulations related to employment.

Our solicitors in Dubai are at your disposal and can offer guidance in various legal matters.

How is debt collection made in Dubai?

The collection of payments in Dubai is not a complex procedure and, in most cases, it can be performed through the amicable procedures instead of lawsuits. Foreign investors with companies in Dubai should solicit the support and the legal advice from our lawyer in Dubai if they are interested in a debt collection procedure and if they want to know the implications in this matter. An amicable approach consists of a payment notice sent to the debtors, and then a communication commences between the two parties involved in debt recovery. The legal actions for the recovery of the payments in Dubai will only start within 60 days if the amicable procedure was not a suitable option. If you would like to know more about the legal implications in a debt collection procedure, please address to our team of lawyers in Dubai.

Set up a company in Dubai, helped by our lawyer in Dubai

Do you intend to open a company in Dubai? You may contact our law firm and settle an appointment or send us your request via e-mail and we will offer you the best solution tailored to your business specific. The foreign citizens who don’t intend to live and work in Dubai, for their business, may open an offshore company and the entrepreneurs who want to move to UAE have a larger range of choices because there are many types of companies they can set up. Whatever type of company a foreign investor may choose to open, our attorneys in Dubai will handle the entire procedure – from providing the useful information about the procedures to follow and submit the documents and register the company. The foreign citizens who open offshore companies in Dubai will benefit from important advantages, such as: low corporate tax (9%) low VAT, privacy protection, no minimum share capital required in certain free zones, the company may have a 100% foreign ownership etc. Among the aspects related to company formation in Dubai, our lawyers in Dubai mention the most important ones:

- one must choose the business sector and the activities for the future company in Dubai;

- a name verification is mandatory before the documents are provided to the authorities;

- the Articles of Association offer complete information about the owners, the board of managers, activities, legal rights, etc.;

- the business location for the company’s main office in Dubai is the next thing to consider at the time of formation;

- depending on the business activity in Dubai, the company will activate with specific licenses and permits.

If you need legal support, you have several legal firms in Dubai from which you can choose.

The Free Zones in Dubai

The Free Zones are special areas within the city of Dubai that encourage certain activities, according to their profile. They are designed to meet the needs of investors from a wide number of business fields: from technology to medicine or media, Dubai’s Free Zones offer a tax-free regime and exemption from customs duty. There are more than 30 Free Zones currently operational in Dubai. Here are some of the most popular among investors:

- Dubai Healthcare City;

- Dubai Internet City;

- Dubai International Financial Center;

- Dubai Media City;

- Dubai Gold and Diamond Park;

- Dubai International Academic City;

- Jebel Ali Free Zone.

The attorneys at our law firm can offer you information about each special zone and together with our agents you can open a company here which will have full foreign ownership. If you have any questions, our solicitors in Dubai can answer them.

Support for licenses and permits in Dubai

Most of the business activities in Dubai are subject to industrial, professional and commercial licenses. The institution that issues the necessary licenses and permits is the Department of Economic Development in Dubai. These licenses are valid for one year, but companies in Dubai can apply for a renewal. We mention that the Ministry of Economy and Commerce in the UAE is in charge of the approvals and permits for companies with activities in the manufacturing sector. We are at your disposal with assistance in preparing the documents for the necessary licenses and permits.

When having to choose between legal firms in Dubai, it is advisable to select one that has experience in the matter you are interested in.

Tax minimization and consultation

Our lawyers in Dubai also offer tax consulting services and they can offer you solutions for legally minimizing the taxes your company has to pay. The owner of a company in Dubai may need advice regarding the taxes he must pay for his company and for the personal income he makes abroad, payroll services and other financial issues. Besides our attorneys in Dubai, we have a team of accountants who may offer a wide range of financial services. They will explain how you may avoid the double taxation by means of double tax treaties signed by UAE and other countries.

Company liquidation in Dubai

If a company cannot perform its normal business activities, including the necessary payments to the creditors, a liquidation procedure might be a proper solution in this case. The decision of liquidation is an important document that needs to be provided with the registration certificate of the firm. The same registration authority deals with the company liquidation in Dubai, and that is the Trade Register. The owners and the board of directors are in charge of the company’s decision of bankruptcy and the ones who will sign the dissolution documents. It is good to know that an approved liquidator will commence the insolvency procedure for a company in Dubai and will sign the related documents. Feel free to get in touch with our lawyer in Dubai for complete legal assistance and representation at the time of company liquidation who will act in agreement with the applicable legislation.

Our solicitors in Dubai can offer guidance in all sorts of the legal issues you might deal with.

Why invest in Dubai?

Dubai is one of the fastest growing financial centers in the world. Its taxation system is perhaps its greatest strong point but the city also has other advantages for the investor or expat who is looking for employment in Dubai. The high quality of living might come at a more significant price than in other cities (after all, Dubai is known for its extravagant lifestyle) but the city is also one of the safest in the world. Our consultants will be able to answer any questions related to company formation and foreign ownership in the United Arab Emirates. For more details about the legal services offered by our law firm, you may contact our lawyers in Dubai.

The court system in Dubai

Dubai has its own courts system and it is not subject to the federal Supreme Court. The Court of Cassation is the highest court in Dubai and it only hears matters of law and it is not an appellate court. It supervises the lower courts to ensure that they apply and interpret the law accordingly. Lower courts in Dubai observe the legal principles imposed by the Court of Cassation.

The other types of courts in Dubai are the Courts of First Instance and a Court of Appeal. These three types of courts have three divisions: a civil one, a criminal one, and a Sharia one.

The Court of First Instance is the one for the first degree of litigation. The Court of Appeal is the second degree and the final and highest is represented by the Court of Cassation.

Commercial matters, including cases that may concern foreign business owners in Dubai, are brought before the Civil Court, also known as the Court of First Instance. Debt recovery cases are included in the commercial matters category, as well as any disputes that can be related to other matters, for example, maritime disputes. Claims for commercial first instance proceedings can be brought before a court by any individual above the age of 21. Business owners who cannot be present in Dubai to file a claim can empower a legally competent individual to represent their interests in court. One of our lawyers in Dubai can act on your behalf in commercial proceedings.

The Sharia or Islamic courts in Dubai are responsible for dealing with civil matters between Muslims, particularly family disputes like divorce, child custody and others. Non-Muslims do not bring cases before a Sharia court.

Our Dubai lawyers can offer you legal representation regardless of the type of legal dispute.

Legal judgments in Dubai

The Court of First Instance delivers an initial judgement for a case, but the parties have the right to appeal to the Civil Court of Appeal within 30 days after the initial judgement has been delivered. The grounds for appeal must be legal and, at this stage, parties can bring forward additional evidence and request additional witnesses who will testify. Criminal actions in Dubai commence by filing a complaint with the local police department belonging to the jurisdiction in which the offence took place.

Requests for claim registrations are subject to terms and conditions and the plaintiff must provide adequate documentation to justify his cause. Part of the required documents in case of legal claims in Dubai include a declaration submitted by the plaintiff (containing the names of the plaintiff and defendant as well as the actions that brought the case to court), evidence, the document proving legal representation and proof of payment for various legal fees.

Immigration to Dubai with the help of our solicitors

Dubai is one of the appreciated tourism destinations in the world, and it only suffices for you to visit once in order to want to move here. This is possible, as the authorities here have created favorable rules for those interested in starting a business or working for Dubai companies.

With a large number of expats already living here, there are two options for those who want to buy properties in Dubai. They can acquire real estate in freehold or leasehold zones, under certain circumstances being possible to even obtain residency through property purchases.

If you want to acquire real estate in Dubai, here is how our law firm can help you:

- we can check the seller and the property;

- we can draft the pre-sale agreement followed by the sale-purchase contract;

- we can guide through the procedure of registering the property with the Land Register.

If you are interested in acquiring residency through real estate purchase, here are the main conditions you must be aware of its value must be at least 1 million AED if it is located in a freehold area. Such an investment comes with a 3-year residence permit. For an investment of 5 million AED, you can obtain a 5-year residence permit.

The program also addresses retired persons with a minimum age of 55 who are required to invest at least 2 million AED.

There are also other ways of obtaining residence permits in Dubai, namely through employment, and Oour immigration lawyers in Dubai are at your service in this sense.

The investment visa for Dubai is a new immigration option the United Arab Emirates government has introduced for wealthy or highly qualified foreign nationals. Depending on the applicant’s eligibility category, this sort of visa is granted for a period of 5–10 years. Furthermore, if you meet the requirements, you don’t need a sponsor in the UAE to submit your application on your behalf.

There are many legal firms in Dubai you can appeal to if you want to move here or in one of the free zones.

{pyro:chestionar:chestionar}

Why choose our law firm in Dubai

With a vast experience in various aspects of the law, our lawyers in Dubai have been at the service of expats and foreign investors coming here for many years now. We always try to do the best for our clients, which is why are updated with the latest changes in the legislation, so that we can provide good counsel.

We can resolve any request in a timely manner, as we value our clients’ time. All your questions will be answered in due time and representation is provided on all level required.

Our solicitors in Dubai are at your service for assistance civil and commercial matters.

We are one of the legal firms in Dubai that can offer quick support no matter the problems you face.

If you need more information about our legal services, please contact our lawyer in Dubai. We remind you about ourimmigration lawyers in Dubai who will help you move here.

We can also recommend you other types of services, such as hiring luxury cars in Dubai.