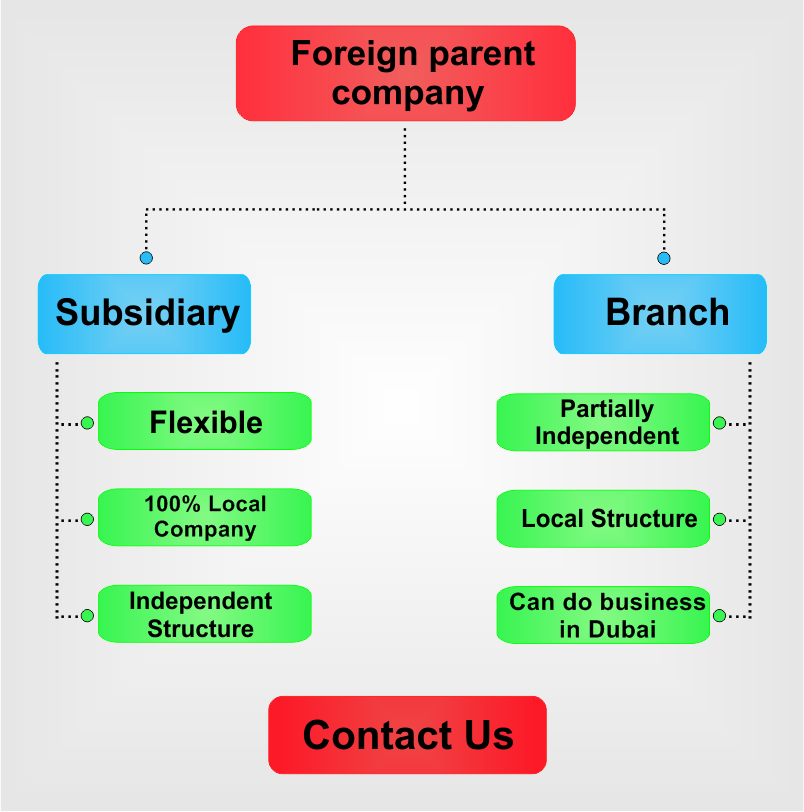

Dubai is the most important business hub and trading center in the Middle East. The emirate offers great tax advantages to companies and establishing a business there can be very advantageous for foreign traders. When choosing to conduct economic activities in Dubai, investors must also choose the appropriate business form. Two of the most popular legal entities for foreign companies are the branch and the subsidiary. Each of them has its own particularities and the differences between a company branch and a subsidiary in Dubai can be relevant to the business plans of the company. Our Dubai lawyers can help you understand these differences and see how one business form or another can be beneficial for your business in Dubai.

Branches in Dubai

Dubai has several important free zones and many foreign companies open branches in these areas that offer advantages for foreign investors. A branch is Dubai needs to be registered with the Ministry of Economy and it cannot perform certain restricted activities, like commercial agencies or restaurants. Also, the nature of this business form allows it to perform only activities similar to those performed by the mother company abroad. A branch in Dubai is not a separate legal entity, but it is bound to the founding company. The company abroad is liable for the branch’s debts and obligations and must appoint a representative in Dubai to take care of the branch’s affairs.

Our attorneys in Dubai can assist you with the company incorporation procedure. The foreign investors will have to submit certain documents when registering the branch in Dubai, such as:

- relevant documents about the parent company (the certificate of registration);

- a board resolution authorizing the opening of a branch in Dubai;

- a statement containing the branch’s main operations and activities in Dubai;

- a set of copies of identification cards of the owners and managers.

Our immigration lawyers in Dubai are at your service if you want to bring foreign employees or family here. You need a freelance permit if you are already a resident of the UAE but you have entered the country on your spouse or parents’ visa through sponsorship. If you have had a full-time job in the UAE and want to work independently, you can also apply for a freelance visa in Dubai following termination of employment. For details, you can address our local law firm.

Before applying for any type of visa for the UAE, it is recommended that you verify your eligibility score. You can do that with the help of our lawyers. They can help you check if you are eligible for a regular residence permit or even for the Dubai investment visa. If everything is in order, we can help you apply for it.

Subsidiaries in Dubai

The subsidiary in Dubai is an actual separate legal entity from the parent company. This means that the foreign corporation will no longer be liable for the actions of the subsidiary, as it was the case with the branch. The subsidiary will have its headquarters in Dubai and the management activities will take place in the emirate. Foreign business owners can open a subsidiary in one of the free zones or outside of them if they have a UAE national business partner that owns 51% of the company. This type of legal entity will have to observe the taxation laws in Dubai and will have to obtain the necessary permits for functioning and for hiring employees.

Immigration to Dubai is possible as a foreign employee of a subsidiary company,

Find out from this video what the best option for your company in Dubai is and how you can establish a branch or a subsidiary:

What are the benefits of branches in Dubai in 2024?

Besides the tax regime in Dubai’s free zones which probably represents the main advantage of a branch established in this city, one should know that the incorporation procedure is fast, it has low costs and it is subject to share transfers directly to investors or shareholders.

Those who want to open branch offices in Dubai in 2024 will benefit from full control over their activities in the Emirate. Even if these are usually employed for financial activities, they can also be used for other operations that require complete supervision and the direct approval of the parent company.

If you need updated information on how to open a branch in Dubai in 2024, our lawyers can advise you.

What are the benefits of subsidiaries in Dubai for 2024?

Subsidiaries are usually known as flexible and independent structures and due to these important attributes, these entities provide more credibility among customers and potential collaborators on the market in Dubai in 2024. This is one of the solid arguments when thinking of establishing a subsidiary instead of a branch in Dubai. Additionally, a subsidiary can be registered in Dubai in a form of a limited liability company, a widely used type of business on an international scale.

What are the cons of branches in Dubai?

Even though branches in Dubai can be 100% foreign owned and represent an extension of the parent company, these are not separate legal entities. The taxation will be made on the revenues registered by the branch in Dubai. Compared to an LLC in Dubai, the bureaucratic conditions might prolong.

What are the disadvantages of subsidiaries in Dubai?

The main disadvantage linked to a subsidiary in Dubai is the financial liability of the mother company. It is good to know that establishing a subsidiary is subject to high expenses compared to the purchase of the ready-made companies in the UAE. Even though a subsidiary is a separate legal entity, the parent company is responsible for the actions and operations of the established subsidiary. More than that, subsidiaries in Dubai need to respect the local business and commercial procedures to avoid any penalties.

At the level of 2024, a Dubai subsidiary can operate like any other domestic business, however, it must apply for its own licenses with relevant authorities in the UAE.

Comparison table for branches and subsidiaries

The following table represents a comparison between the two entities which are available for business in Dubai for both domestic and foreign investors:

| Basis of comparison | Subsidiary | Branch |

| Definition | It is an independent legal entity | It performs the same business activity in any country |

| Reports to | Holding Company | Head office |

| The Business | Can perform the same operations or not | Has the same operations |

| Separate legal entity | YES | NO |

| Account maintenance | Separately | Jointly or separately |

| Ownership interest | the parent company has >50%-100% ownership | 100% ownership in the branch |

| Obligations | Limited to the subsidiaries | extends to the parent company |

Each of the above-mentioned attributes can be entirely explained by our Dubai attorneys who can also provide legal assistance for foreign entrepreneurs who are interested in placing their operations in the UAE.

Main differences between branches and subsidiaries in Dubai

The key facts about the branches and subsidiaries available in the UAE are of high importance and must be fully understood before registering any of the two entities. For example, a branch established in the UAE is dependent on the parent company with the mention that it has to operate the same activities, but in a different location. The financial report is made to the head office compared to the subsidiary which has to report to the holding company that, as the name says, holds the majority shares. In other words, we mention that the subsidiary is fully independent of the parent company compared to the branch which has to report all the operations to the company from the country of origins. It is good to know that a subsidiary in Dubai may implement different activities from the parent company. As for the branch, this can only implement and develop the operations of the mother company, due to the dependent status of the entities. As for the investments which need to be made when opening a subsidiary or a branch, the foreign company is obliged to have 100% ownership in the branch, while for a subsidiary between 50% and 100%. The responsibilities of a branch in Dubai are entirely connected to the company from abroad, while the subsidiary has no liabilities which extend to the parent company. We invite you to address to our team of advisors and find out more about how you can establish a branch or a subsidiary in Dubai and about the legal aspects involved. They can also help you in immigration to Dubai as well as registration for EORI in Dubai.

The Articles of Association for branches and subsidiaries

The Articles of Association (AOA) are a company’s main documents which comprise complete information about the owners, the operational activities, the structure, the financial records and details about the board of managers in the firm. The same documents mention information about the voting rights in the company and about the rules and tasks in the firm. Compared to the Memorandum of Association, the Articles of Association do not need to be registered, however, if the company owners decide in this direction, AOA can be recorded to the Trade Register. Feel free to ask any questions about how to prepare and submit the Articles of Association for your branch or subsidiary in Dubai.

Other details you need to know about the branches and subsidiaries in Dubai

In 2024, the sectors in which a branch or a subsidiary can be established in Dubai are the manufacturing, business consulting, tourism, and commercial trading. Investors can also expand their businesses by establishing the activities as service providers in Dubai. Jebel Ali Free Zones, Dubai Silicon Oasis, Dubai World Central, Dubai Auto Zone, or Dubai Logistics District are only a few of the free zones available for business activities from abroad, whether as branches or subsidiaries. The legal aspects connected to these two forms of business can be explained by our advisors. Summing up the article about the branches and subsidiaries in Dubai, the conclusion is the first one is chosen by a foreign company to easily implement the products and the services in a foreign country. On the other hand, the subsidiaries are established as part of the company’s operational development in countries worldwide with the mention that such entity can establish different activities from the parent company, due to their independent status. It is good to know that no matter the entity a company chose, this has to respect the applicable laws in the UAE, especially the Company Act, the Competition Law, and the Anti-Trust Law. Such set of laws are of high significance and they can be completely explained by our team of lawyers in Dubai who can also provide the necessary assistance for any kind of entrepreneur who is interested in opening a business in the UAE.

Dubai’s economic performance, a good reason to start a business in the UAE

Despite the global uncertainty and problems, the economy has performed very well over the past year. The Economy Minister reports that the UAE’s GDP increased by 3.7% over the first half of 2023. For 2024, uncertainties and difficulties are still expected in the context of the world economy. These include a slowdown in global trade, a reduction in tourism as a result of weaker global growth, a decline in the need for oil, and geopolitical changes. Nevertheless, according to the International Monetary Fund, the UAE has put enough financial security measures in place to offset these challenges. The UAE Ministry of Economy has released an economic blueprint for 2024–2117 that aims to advance several sectors and encourage sustainability.

Our law firm in Dubai offers company incorporation services and can help you open a company in this emirate. We kindly invite you to contact us if you need assistance from a legal point of view or if you would like to know more about branches and subsidiaries in Dubai. You can also get in touch with our immigration lawyers in Dubai for guidance in moving here to run a foreign business.